ST/OT Transfer Order Accounting in JD Edwards. Part 4.

ST/OT Transfer Order Accounting in JD Edwards. Part 4.

Ed Gutkowski – Chief Architect – RapidReconciler

ST/OT transfer orders in JD Edwards are used to move materials between branch plants (A to B) within the same company and employs the use of a clearing  account to hold the value of the goods while they are in transit. This balance sheet account differs from a perpetual account because while the goods are in transit the quantities on hand “disappear” from the perpetual counts and only remain as a balance in the clearing account.

account to hold the value of the goods while they are in transit. This balance sheet account differs from a perpetual account because while the goods are in transit the quantities on hand “disappear” from the perpetual counts and only remain as a balance in the clearing account.

My article from last month was about DMAAI set up when transferring goods at cost. In that scenario, any variance between the cost on the ST order and the price on the OT order could be handled by setting the purchase price variance DMAAI to the In-Transit clearing account. Now let’s take a look at the ‘OT’ side of things using a transfer at cost scenario, but where there is a standard cost variance.

There are 3 main DMAAI tables that come into play during the receipt of an OT order:

4310 – Inventory Debit

4320 – RNV (Used in this case for the Goods In-Transit account) Credit

4335 – Purchased part variance

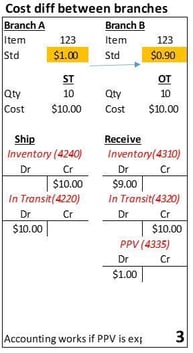

Now, let’s continue with our example and say there is a standard cost in branch ‘A’ of $1. Let’s also say that the standard cost is NOT updated in branch ‘B’ but remains at $0.90. The ST and OT are created with $1.00 amounts as the cost/price, respectively. What happens now?

The ST and OT will have the $1.00 as the cost/price. The shipment results in a proper credit to the inventory account of $10 and matching debit to goods in transit.

Now let’s continue the receipt side of things …

Our OT order in JDE is still expecting a $10 receipt. Nothing has updated the $0.90 standard cost in the branch.

This is how we can use DMAAI 4335 to still make the accounting work as shown in the figure on the left:

Set up of DMAAI’s:

Table 4310 – Remember the standard in branch ‘B’ was not updated and remains at $0.90. It will correctly record an $9 debit to the perpetual inventory account.

Table 4320 – Because the unit cost on the purchase order is still $1, it will credit goods in transit $10, effectively clearing the In-Transit account. But what about that $1 variance?

Table 4335 – Here is where we need to set this DMAAI to the PPV expense account. This properly expenses the variance.

Readers: But hold on a minute Ed!!!! Last month you said to set DMAAI to the In-Transit account. What gives?

Me: Yes, I did say that, and it was certainly correct for the scenario being shown. This is a different scenario so the accounting will work differently.

Readers: But I can only set the DMAAI up 1 way, isn’t that correct?

Me: Sure is. The lesson here is that there is no perfect way to set up the DMAAI’s for an ST/OT transfer order. The best approach is to set it up for the scenario that occurs most often in your organization!

Until next month …. Happy reconciling!

FOR MORE INFORMATION ON JD EDWARDS 9.2.4 OR GSI'S JD EDWARDS SERVICE OFFERINGS

CONTACT US TODAY

FOR MORE INFORMATION ON JDE 9.2.4 OR GSI'S JD EDWARDS SERVICES